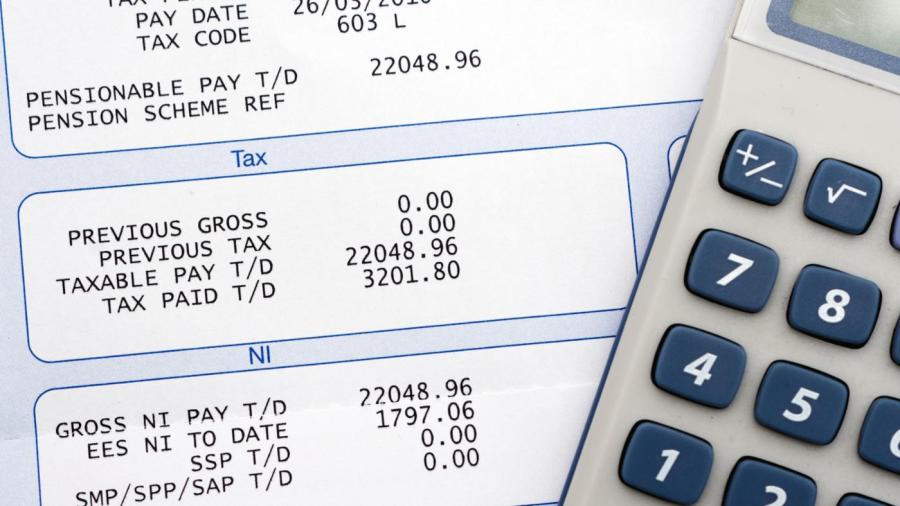

What Is the Percentage Taken Out for Taxes on a Paycheck?

Precise percentages vary based on state, but according to the Ventures Scholars Program, four primary taxes are withheld from paychecks: federal income tax, state income tax, social security tax and Medicare tax. According to The Law Dictionary, taxes are withheld on a sliding scale that extracts more income from higher-earning individuals, topping out at 39.6 percent in 2014.

The IRS website provides a calculator that allows employees to determine whether the correct amount of federal income tax is being withheld. Withholding tax is paid out of an employee’s wages directly from the employer to the IRS and is used to fund social security, Medicare, unemployment compensation and worker’s compensation. The amount is determined by the W-4 form, which is used by employers to calculate how much to deduct. The IRS recommends that a new W-4 be submitted whenever an employee’s financial situation changes. The W-4 also allows filers to control to some extent how much is withheld, but the U.S. Tax Center advises that the withholding tax match the actual tax liability as closely as possible. While receiving a large tax refund is enjoyable, tax refunds are interest-free loans provided to the government. Withholding too little results in owing the IRS, who may also charge penalties and interest.