The COVID-19 Pandemic Could Affect Your Taxes — Here’s How

The COVID-19 pandemic of 2020 affected countless aspects of daily life, so it likely doesn’t come as a surprise that even your taxes aren’t immune to these effects. Last year’s events ushered in several important updates you need to know about before filing your 2020 income taxes. From stimulus payments to tax credits for small business owners, we’ll key you in on several fundamentals to be aware of.

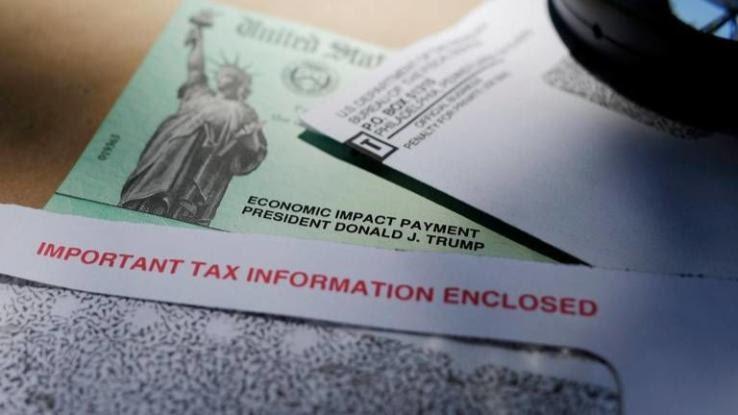

Stimulus Payments and Credits

As businesses across the country were forced to shut down throughout 2020, many Americans received stimulus checks, or Economic Impact Payments. The first was issued in April and the second in December. If you received one or both 2020 stimulus checks, it may come as a relief to learn that they don’t count towards your taxable income for the year.

Stimulus checks were essentially considered a credit by the IRS, so they shouldn’t affect or reduce your refund in any way. Just make sure to note that you already got them if asked when filing. Additionally, if you think you may have qualified for a larger payment due to a reduction in income, a new baby or another qualifying factor, you can claim the missing amount as a Recovery Rebate Credit.

If you didn’t receive one or both of 2020’s stimulus payments or didn’t receive the full amounts for some reason, you may also be eligible to receive the Recovery Rebate Credit. This means you can subtract the amounts from the total amount you may owe the IRS. In order to claim these credits, you need to file 2020 taxes, even if you wouldn’t otherwise be required to file.

Unemployment and Job Changes

The COVID-19 pandemic also changed the work situations of millions of Americans in 2020. If you received unemployment benefits — which are taxable — in 2020, then it’s likely that you were asked whether or not you wanted to have taxes withheld from each payment. If you chose not to have taxes withheld, then be aware that you’ll need to pay them on your federal income taxes.

If you received unemployment benefits during 2020, then the government will send you a copy of Form 1099-G, Certain Government Payments. This shows how much money you received in benefits, as well as how much money you had withheld. You’ll also need to pay taxes on any freelance work or side gigs you picked up during the year on Form 1040 Schedule C.

Unfortunately, you won’t be able to deduct business-related expenses you may have incurred if you ended up working your regular job from home. That said, you can deduct benefits for such expenses if you run your own business or side business from home.

CARES Act Considerations

The CARES Act also made special provisions for costs and transactions like medical bills and retirement account Required Minimum Distributions (RMDs) and withdrawals. Among them was a waiver for retirees who wanted to forgo RMDs during 2020. “Because most accounts have seen a steep decline in 2020, the amount of the required withdrawal would have been a much larger percentage of a retiree’s account,” explained Rob Williams of the Schwab Center for Financial Research. “The law lets retirees keep that money in their accounts, potentially recouping some of the market losses when the economy turns around.”

On the other hand, the IRS also allowed non-retirees to withdraw money from their 401(k)s or IRAs during 2020 without being taxed an extra 10% for early distribution on amounts less than $100,000. There are also special provisions for those who paid more than 7.5% of their adjusted gross income in 2020 towards medical bills or expenses. If you fall into this group, then you’ll be allowed to deduct those expenses above the 7.5% from your taxes.

PPP Loan Forgiveness

Throughout 2020, the Paycheck Protection Program (PPP) turned out to be an important lifeline that helped many small businesses and their employees stay afloat. Many of these loans are eligible for forgiveness if they were used for purposes such as payroll, mortgage interest, rent and utilities within a qualifying amount of time.

Due to the year’s special circumstances, Congress elected to forgive PPP loans and exempt them from federal income taxes in 2020. While this is true on a federal level, not all states have followed the same rules. It’s essential to find out where your state stands as far as forgiven PPP loan exemptions if you received these loans.

Another important consideration for employers is a measure found in the CARES Act that allowed them to provide employees with up to $5,250 in student loan repayment money, tax-free. Under this law, employers who made payments towards the educational loans of their employees between March 27, 2020, and Dec. 31, 2020 can exclude these amounts from the employees’ taxable income.

Tax Credits for Business Owners

The Families First Coronavirus Response Act (FFCRA) of 2020 also provides additional tax credits to small businesses and self-employed business owners. Qualifying businesses can receive refundable tax credits if they paid out sick leave or expanded family medical leave for employees affected by COVID-19 from April 1 through December 31 of 2020.

Keep in mind that such credits are only available to cover payments that were directly related to COVID-19 situations or that helped eligible employees maintain their health insurance. This credit program in particular can be a little complex as far as its eligibility and time requirements are concerned, so be sure to research any questions you may have on the IRS’s COVID-19-Related Tax Credits page or consult a tax advisor for further assistance.

Trump Payroll Tax Deferrals

Some employers may also be familiar with the Trump Payroll Tax Deferral that was issued in August of 2020. Under this presidential order, employees were allowed to defer their Social Security tax contributions from September 1, 2020, to December 31, 2020. In order to take advantage of this program, employees had to agree to a double withholding until the total amount was repaid from January 1, 2021, to April 30, 2021. As a result, employers will need to report any deferred amounts on Form 941 and make sure to work with employees to calculate how the deferrals will be taken out of their 2021 paychecks.

Under the CARES Act, some businesses were also allowed to defer the employer portion of FICA (Social Security and Medicare) taxes during 2020. If you took advantage of this program, you’ll need to report it on Form 941 as well. You must also repay at least half by the end of 2021 and the remainder by the end of 2022.

Those who were self-employed from March 27, 2020, to December 31, 2020, also had the option to defer 50% of their Social Security taxes on net earnings. Any self-employment deferments under this provision are subject to the same repayment rules as those for businesses. Both types of business owners who took advantage of these deferrals are entitled to a tax deduction in either the tax year that the payment is due or made, depending on whether they operate on an accrual or cash basis.